Table of Contents

- IVV Kalos Vase Optic Clear - Artelia

- IVV: iShares Core S&P 500 ETF의 티커 심볼

- iShares Core S&P 500 UCITS ETF (CSPX): Koers, Nieuws en Analyses

- Ishares Core S P 500 Etf Chart - Ponasa

- iShares核心標普500指數ETF (IVV). iShares Core S&P 500 ETF… | by Psgbpsgb | Medium

- S&P500 ETF ASX:IVV vs iShares Global 100 Brands IOO - YouTube

- iShares on Twitter: "Trying to figure out a long-term growth strategy ...

- Letter IVV Template stock vector. Illustration of management - 104761127

- iShares Core S&P 500 UCITS ETF (CSPX): Koers, Nieuws en Analyses

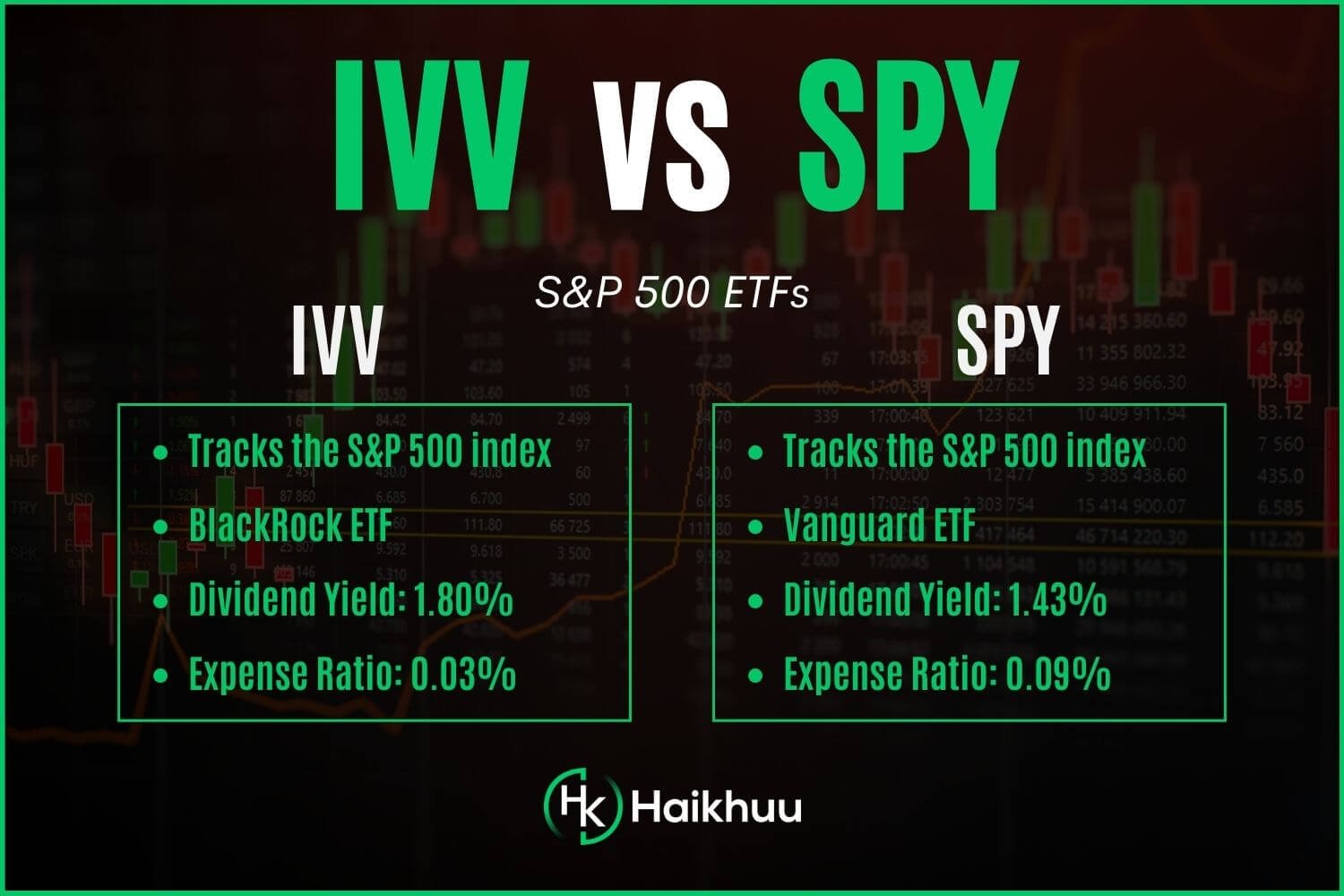

- SPY vs. IVV: Which is Best For You — HaiKhuu Trading

What is the iShares Core S&P 500 ETF (IVV)?

Benefits of Investing in the iShares Core S&P 500 ETF (IVV)

Risks and Performance

As with any investment, there are risks associated with investing in the iShares Core S&P 500 ETF (IVV). The fund's performance is closely tied to the performance of the S&P 500 index, which can be affected by a range of factors, including economic conditions, interest rates, and geopolitical events. However, the IVV has a long history of strong performance, with a 10-year average annual return of over 13%. The iShares Core S&P 500 ETF (IVV) is a popular and cost-effective way to invest in the US stock market. With its diversified portfolio, low costs, and flexibility, the IVV is an attractive option for investors looking to gain exposure to the US market. While there are risks associated with investing in the IVV, its long history of strong performance makes it a solid choice for investors looking to build a diversified portfolio.For more information on the iShares Core S&P 500 ETF (IVV), including its current price, performance, and holdings, visit the iShares website. Additionally, you can check the latest news and updates on the US News website.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.